The Big List Of Payment Gateways For The Global Merchant

When I was a kid, I ran a lemonade stand where I would sell lemonade for 50 cents. Easy money. Everyone likes lemonade and everyone likes kids. But I remember distinctly running into my first business problem.

There was one guy who only had a twenty dollar bill. I had $11.50 in takings and he would need $19.50 in change. What to do? Well, in that case, get my dad. In the big bad world of e-commerce, though, taking payments is still one of the most aggravating of problems for the merchant.

There are a few excellent payment gateways that have come along and made it easier for people in the US to take payments like Stripe, Dwolla, and WePay. What are the options for the non-US merchant, though? What can they use to take payment?

Not PayPal

The obvious answer is, was, and I worry always will be, PayPal. Although there are any number of people who dislike PayPal, it is still a payment portal that is widely supported, affordable to use, and familiar to customers. It should always be treated as a viable, if unenviable, option.

In this post, though, I will direct you to some other payment processing options that are available. I have grouped them by country and continent to make it easier for you to pick out one that applies to your situation. There are a few rules that determine inclusion or exclusion from the list:

- I consider a payment portal to work in a country if the merchant can accept payments while living in that country.

- If your customers can make payments in a country, but you cannot accept payments in that country, I will not include it.

- If you can receive payments in a country, but not in your currency, I will still include it.

- If it has a WordPress plugin, I will include it.

- If it offers a payment gateway that can be used with a shopping cart that can be used with WordPress, I will include it.

- I will not include a payment gateway that is only available to US-based merchants.

Global

These are the options that work in most places. There will be holes in any network, but these work in most major markets. If you don’t see a country specific one (I’m looking at you, Turkey) then check out these as your next best options:

- Authorize.net | (Global) | WordPress Integration (Most shopping carts will include this as a default option)

- 2Checkout | Website | WordPress Integration

- Payza | WordPress Integration

- WorldPay | Website

- Wirecard | WordPress Integration

- MiGS | Website

- AlliedWallet | Website

- FirstData | Website | WordPress Integration

- Skrill | Website

Europe

Those payment gateways below with an asterisk (*) next to them are also able to process ELV payments.

- Bulgaria

- ePay.bg | Website | WordPress Integration

- Croatia

- PayWay | Website | WordPress Integration

- Europe Wide

- CertoDirect | Website | WordPress Integration

- PayPoint WordPress Integration

- Finland

- Checkout.fi | Website | WordPress Integration

- Paytrail | Website | WordPress Integration

-

An Infographic From Intuit On Why Small Businesses Need to Adopt E-commerce Germany

- Sofort | Website | WordPress Integration

- Barclaycard ePQD* | Website | WordPress Integration

- Wirecard* | Website | WordPress Integration

- WorldPay* | Website | WordPress Integration

- Ireland

- Realex | Website | WordPress Integration

- Italy

- Gestpay | Website | WordPress Integration

- postepay | Website | WordPress Integration

- The Netherlands

- Northern Europe

- Klarna | Website | WordPress Integration

- Poland

- Przelewy24 | Website | WordPress Integration

- PayU.pl | Website | WordPress Integration

- Portugal

- IfMB | Website | WordPress Integration

- Romania

- PayU.ro (GECAD ePayment) | Website | WordPress Integration

- Russia

- WebMoney | Website | WordPress Integration

- Robokassa | Website | WordPress Integration

- QIWI | Website | WordPress Integration 1 & 2

- Scandinavia/Denmark

- ePay.dk | Website | WordPress Integration

- DIBS | Website | WordPress Integration

- Spain

- ServiRed | Website

- Sweden

- Payson | Website | WordPress Integration

- UK

- Sage Pay | Website | WordPress Integration

- GoCardless | Website | WordPress Integration

An Infographic On How Online Credit Card Processing Really Works From CheckoutMerchants.com - SecureTrading | Website | WordPress Integration

- eWay.co.uk | Website | WordPress Integration

Asia

- Asia

- PayDollar | Website | WordPress Integration

- China

- India

- PayU.in | Website | WordPress Integration

- CCAvenue | Website | WordPress Integration

- Japan

- Zeus | Website | WordPress Integration

- Remise | Website | WordPress Integration

-

An Infographic On Global ECommerce Epsilon | Website | WordPress Integration

- Paygent | Website | WordPress Integration

- Malaysia

- iPay88 | Website | WordPress Integration

- MOLPay | Website | WordPress Integration

- Phillipines

- PesoPay| Website | WordPress Integration

- PayEasy | Website | WordPress Integration

- Thailand

- SiamPay| Website | WordPress Integration

Oceania

- Australia

- eWay AU | Website | WordPress Integration 1 & 2

- NAB Transact | Website

- e-Path | Website | WordPress Integration

-

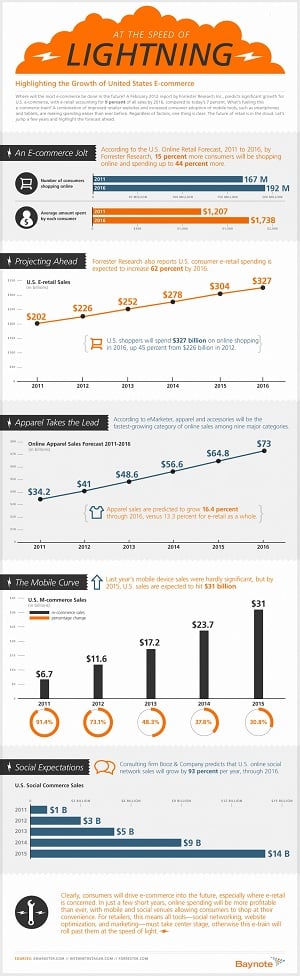

An Infographic On The Future Of ECommerce From Baynote.com Merchant Warrior | Website | WordPress Integration

- SecurePay | Website

- New Zealand

- eWay NZ | Website | WordPress Integration

- Oceania

- ANZ eGate | Website | WordPress Integration

Africa

- South Africa

- PayFast | Website | WordPress Integration

- MyGate | Website | WordPress Integration

- Netcash | Website | WordPress Integration

South America

- Argentina

- MercadoPage | Website | WordPress Integration

- Brazil

- PagSeguro | Website | WordPress Integration

North America

- Canada

- Beanstream | Website | WordPress Integration

- Moneris | Website | WordPress Integration

- Stripe | Website | WordPress Integration 1 & 2

The Virtual World

- BitCoin

- BitCoin | Website | WordPress Integration

Mobile Payments

- SMS Payment Services

- SmsCoin | Website | WordPress Integration

When Evaluating Any Payment Processor

If you have found a payment gateway that isn’t mentioned on the list (let me know about it in the comments!), here are some questions you can use to evaluate its worthiness and suitability:

FREE EBOOK

Your step-by-step roadmap to a profitable web dev business. From landing more clients to scaling like crazy.

FREE EBOOK

Plan, build, and launch your next WP site without a hitch. Our checklist makes the process easy and repeatable.

- How much does it cost? Most payment gateways charge a percentage of the purchase cost plus a base charge (i.e. 2.9% + 30 cents), but will give discount if transaction volume crosses a certain threshold. Some, like Authorize.net, charge a base fee to use the service. Does this mean you should dismiss it? Well, it depends on the value you get from it. Authorize.net is a very reputable service and can handle whatever volume is thrown at them. If those are priorities for you, then you should consider making the trade-off.

-

Is It Best Of Breed? What is the customer experience like? The division here is really between on-site versus off-site processing. Do you want your customers to leave your site to complete the transaction or to stay on your site? If your site is perceived as being very trustworthy, you’ll want to complete the transaction on your site and reduce the number of steps involved until payment (the likelihood of a sale is indirectly proportional to the number of steps). On the other hand, having a reputable looking off-site processor might increase the confidence that people have in your ability to deliver. It is also worth considering how the payment screen will look; a payment form that is unattractive can reduce potential sales.

- Can it protect you and your customers from fraud and theft? The last thing that a merchant needs is for a Google search of their company to throw up angry blog and forum posts that use the words “scam”, “fraud” and “theft”. How much is it worth to you to avoid that possibility?

- Will it be there in a year? There is no point to going through the trouble and expense of installing a gateway only to have to go through the process again in a year. Balance that, of course, against the possibility of finding a new service that is able to offer something that existing ones can/do not (like Stripe, Dwolla, and WePay).

Have more questions about how how payment gateways and payment processing work? Authorize.net has some really useful explanations of PCI Compliance and How Credit Card Processing Works.

Tags: